This is an Encompass Now template.

Charitable Remainder Unitrust

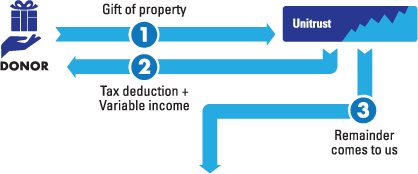

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiaries you name.

- You may use your real estate to fund a charitable remainder unitrust (CRUT), which may be structured to provide lifetime income for you and/or others, or income for a term of years.

- When the trust terminates, the remainder passes to Wells College to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up-front capital gains tax on appreciated assets you give.

- You may be able to make additional gifts to the trust as your circumstances allow for additional income and tax benefits.

Download a brochure on this topic:

Next

- More detail about Charitable Remainder Unitrusts.

- Frequently asked questions on Charitable Remainder Unitrusts.

- Related Gift: Charitable Remainder Annuity Trust.

- Contact us so we can assist you through every step.

The gift planning information presented on this site is intended as general. It is not to be considered tax, legal, or financial advice. Please consult your own personal advisors prior to any decision.

Read full disclaimer|Site Map|Planned Giving Marketing Content © 2024 by MajorGifts.com.